Bonus Alert! Hilton Honors Plus Turns Holiday Spending Into Hotel Perks

- Sam

- Jun 5, 2025

- 3 min read

Updated: Sep 2, 2025

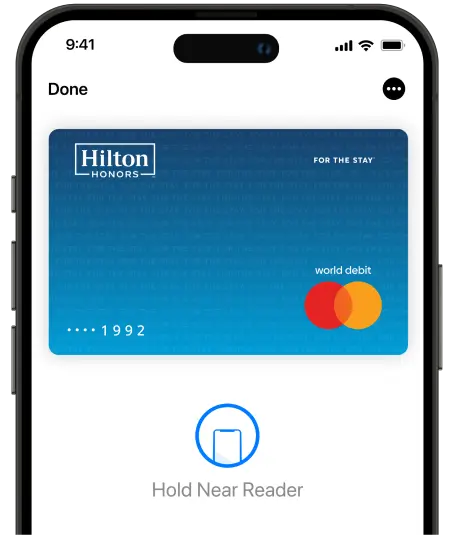

Think travel rewards are only for spreadsheet obsessed nerds with six credit cards? Think again! The Hilton Honors Plus Debit Card is here to prove that perks and bonuses aren’t just for points pros. There’s no credit check, no new bank account - just link it to your existing one, spend like normal (especially abroad), and you’ll bag a 30,000 Hilton Honors Points bonus when you hit £2,500 in foreign spending, instead of the usual 10,000. That’s basically a mini holiday just for being on holiday.

If you've been reading our posts for a while you'll know that we use this card as staple when we're abroad. With it's great earning rates, lack of faff to set it up, and Hilton Gold status chucked in, it puts your free Monzo to shame!

Keep reading to the bottom and we'll let you know how you can earn an extra 1,000 points when signing up!

Hilton Honors Plus Debit Card: Key Features and Bonus

Annual Fee: £150

Welcome Bonus: Earn 30,000 Hilton Honors Points (usually 10,000) when you spend £2,500 in foreign currency within 6 months of card issuance. Apply before 14 August 2025 to secure your chance at this bonus.

Hilton Honors Status: Instant upgrade to Gold Elite status, maintained as long as you hold the card.

Earning Rates:

1.5 Points per £1 spent in the UK

3 Points per £1 spent in foreign currency

4.5 Points per £1 spent at Hilton properties abroad (For a stay at the Auckland Hilton earlier this year we earned 2403 Hilton points for two nights!)

Foreign Exchange Fees: 0% FX fees on foreign transactions.

ATM Withdrawals Abroad: Fee-free up to £500 per month; 2.5% fee applies beyond this limit.

Additionally, there is the "Point Booster" feature: Earn 1 Hilton Honors Point for every 1p rounded up on purchases.

Benefits of Hilton Honors Gold Elite Status

By holding the Hilton Honors Plus Debit Card, you automatically receive Gold Elite status, which typically requires 20 stays or 40 nights annually. Benefits include:

An extra 80% bonus on the base amount of points earned during stays

Complimentary room upgrades if available

Free daily continental breakfast or a food & beverage credit (varies by brand and region)

How It Works

The Hilton Honors Plus Debit Card links directly to your existing UK bank account, allowing seamless transactions without the need for a separate account. At the end of the day, you will receive an email detailing all the transactions made that day, and when to expect the funds to be taken from your current account.

How to apply?

Remember at the top where I said you get yourself an extra 1,000 points?

Click here, and apply before 14 August 2025 for 31,000 Hilton Honors points!

Remember, you must spend £2,500 of foreign spending within six months of applying to secure yourself that bonus.

Is It Right for You?

With its generous welcome bonus, enhanced earning rates, and valuable Gold Elite benefits, this card offers significant value for those aligned with Hilton's hospitality offerings.

But if you’re not chasing elite status or living out of hotel rooms, but you do like the idea of a free breakfast, room upgrades, and making your money work a little harder while you travel, this card is a no-brainer. The Hilton Honors Plus Debit Card is a super simple way to dip your toe into the world of travel perks without getting tangled in credit card terms or points maths. Just spend, earn, and let Hilton do the spoiling.

Sam

Just a quick heads-up: Points Well Made is here to dish out the juicy details on miles and points, but we’re not your financial advisers. Any decisions you make regarding products featured on this site are your own responsibility, and you should always consider whether a product suits your personal circumstances. While we chat about all manner of lender goodies, we’re not a lender ourselves. Remember, you know you best.

Comments